How rising real estate threats might defraud you out of your home

Real estate title fraud is a scam that occurs when the homeowner’s identity is stolen in order to sell or refinance their home without their knowledge. The existence of title fraud just demonstrates the need for more protection for homeowners. Protection begins with real estate agents, lawyers, mortgage brokers, and financial institutions putting protections in place to protect homeowners against fraud. Buying a home is the most expensive purchase that the average person can make in their lifetime, so how could the title to your property be changed to someone else without your knowledge?

Let’s dive into the use cases that have made the news recently.

Two properties were sold without the homeowner’s knowledge by fraudsters who used fake IDs to impersonate the homeowners. They hired a realtor, listed the house, and sold it. These people duped real estate agents, lawyers, a major bank, and Ontario’s land registry. Another example had a fraudster attempting to sell the property of a 95-year-old woman, but the family caught it in time.

In another case, a man attempted to use a fake ID to rent two homes in Toronto but was denied. According to a private investigator working on the cases, the same forged driver’s license was used to rent two Toronto properties that organized crime attempted to sell without the homeowners’ knowledge. This man also attempted to rent other properties but was denied. Thankfully, there are real estate teams and agents that will do their due diligence to make sure that their clients don’t get scammed.

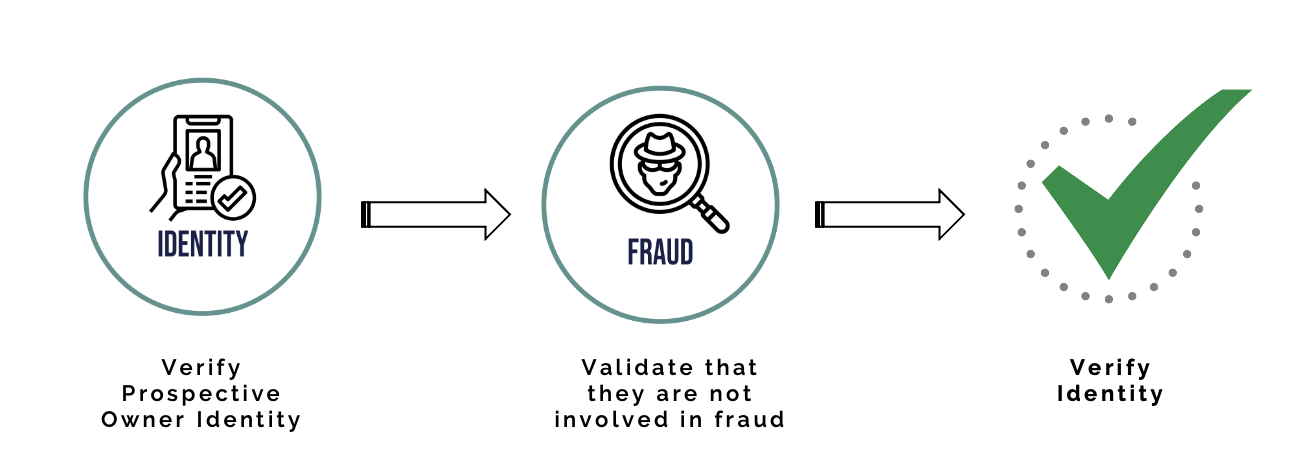

With so many different cases being investigated, there has to be more done to prevent real estate fraud from occurring. Verifying identity should be at the forefront when making billion-dollar transactions. So let’s start with the real estate brokerage; they should do their due diligence and have a third-party identity verification platform to verify that the person is really who they say they are. Given the presence of criminal groups in the real estate industry, any solution implemented must also ensure that the individual is not connected to something nefarious.

Currently, age, address, employment, and FINTRAC are verified when making this significant purchase. But is that enough in today’s rapidly changing world? The real estate industry has to adapt to a compliance verification tool that can easily check more than the items stated above. Unfortunately, the current state of the verification process isn’t regulated well enough because there are properties being sold without the homeowners knowledge. If a person can falsify their documents and create a fake ID and sell that property without the homeowner knowing, there must be a lot of holes in the process to allow that to happen.

What’s the solution?

The first solution is to make sure that you purchase a title land insurance policy when you purchase your home. Pro tip: Don’t purchase a policy during closing. The FCT says, “An owner’s title insurance policy protects the homebuyer from many risks their property could carry, including fraud. In cases of a purchaser unknowingly buying a property from fraudsters, title insurance could be the only recourse. The fraudulent title is of no force and effect, so the buyer can’t resell the property and recoup their funds.” However, this only applies to the homeowner and does not hold the other parties liable.

To buy a home, you should have to prove the validity of the documents listed below:

- Driver’s License

- Birth Certificate

- Passport

- Driver’s License Department of Defence

- Permanent Resident Card

- Citizenship Card (prior to 2012)

- Secure Certificate of Indian Status

- British Columbia Services Card

- Provincial or Territory Identity Cards

- Global Entry and Nexus

- Record of Landing

- Green Card

- Employment Letter

- Pay Stubs

- Bank Statement

- Banking – Transaction Aggregator

- Employer Reference Check (Outbound)

- Digital Employment Verification

- Employment Payroll

- Banking – Bank Supported Credential

- Telco Address Verification

- Address reference check

- Credit bureau address verification

- US Criminal Records

- Canadian Criminal Records

- International Criminal Records

- Sanctions Basic Check – Current Jurisdiction

- Sanctions Expanded Check – Multiple Jurisdictions

- PEP Basic Check – Current Jurisdiction

- PEP Expanded Check – Multiple Jurisdictions

People nowadays are constantly using their phones to access things on the internet, such as homes for sale. As a result, analyzing mobile data can be useful in determining whether or not the individual is who they claim to be. Verifying social KYC can also be beneficial in determining whether the user is related to any accounts with the same name and how long the account has been open; this is also known as passive identity verification. This would help eliminate this type of fraud from happening. If most purchases are now made digitally through your mobile device, then verifying an IP address would help in proving that the person has been using their device consistently because a fraudster wouldn’t use the same IP address each time.

- Phone Number Social KYC

- Phone Number Basic Check

- Phone Number Device and SIM

- Device Location

- Biometrics

- Facial

- Fingerprint

- Voice

- Iris

- Behavioural Biometrics

Your phone already uses biometrics to verify your identity, why shouldn’t you use it to make the largest purchase of your life?

The last solution is, IDVerifact, the most advanced solutions aggregator that can provide everything listed above… and more. IDVerifact can IDVerifact’s CRAView provides a complete set of tools to obtain reported income from the Canadian Revenue Agency directly without your clients needing to produce hardcopies of NOAs or any other documentation and without storing any of that delicate data. OREA, TREB, REBGV, GMREB, and other real estate boards across Canada should implement a tool that can easily verify the person’s identity. Our robust set of solutions can fit any business use case.

Source:

https://www.cbc.ca/news/canada/toronto/standins-real-estate-fraud-toronto-1.6723441

https://www.theglobeandmail.com/canada/article-how-thieves-stole-a-toronto-condo-and-sold-it-for-970000

https://www.theglobeandmail.com/investing/personal-finance/household-finances/article-tenant-fraud-real-estate/

https://www.cbc.ca/news/canada/toronto/fraudulent-home-sale-1.6710868

https://wpdev.idverifact.com/cra-view/

https://wpdev.idverifact.com/solutions/

https://fct.ca/about/