This isn’t your father’s KYC

If you’re in a regulated industry or you’re expanding services to provide regulated products in the future, getting a head start on your digital onboarding and KYC strategy can save you significant time, cost, and overall frustration. Compliance and regulatory requirements have not kept pace with evolving threats across digital channels. Newer solutions, beyond traditional identity verification and sanctions checks, are required to protect your enterprise. With so many providers offering different solutions across fraud, identity, compliance, and risk, it’s hard to find one that has everything that you need to stay compliant and protect your brand.

Knowing your customer is important, which is why a KYC check lowers the risk of onboarding clients who are involved in money laundering, fraud, or other illegal activities. Demonstrating KYC compliance can help your company build brand trust with your customers while reducing your overall exposure to fraud.

You wouldn’t marry someone without first getting to know them, and you wouldn’t hire someone without interviewing them. So why take that chance when onboarding new customers? An IDVerifact KYC Check consists of verifying a customer’s identity across a myriad of solutions incorporating fraud detection, identity verification, compliance monitoring, and risk evaluation on a single customizable platform.

With IDVerifact you are able to quickly define KYC processes leveraging:

- Identity proof

- Risk profile

- Passive fraud detection

- Biometric identity step-up

- Expanded PEP and sanctions screening

- Behaviour-based credit and risk scoring

- Digital attribute collection to support multiple use cases

I know what you’re thinking, this just sounds like a bunch of words, so let’s dive deeper into what they all mean. When onboarding a new customer, you need to verify and validate their identity such as age, address, and biometrics but is that enough?

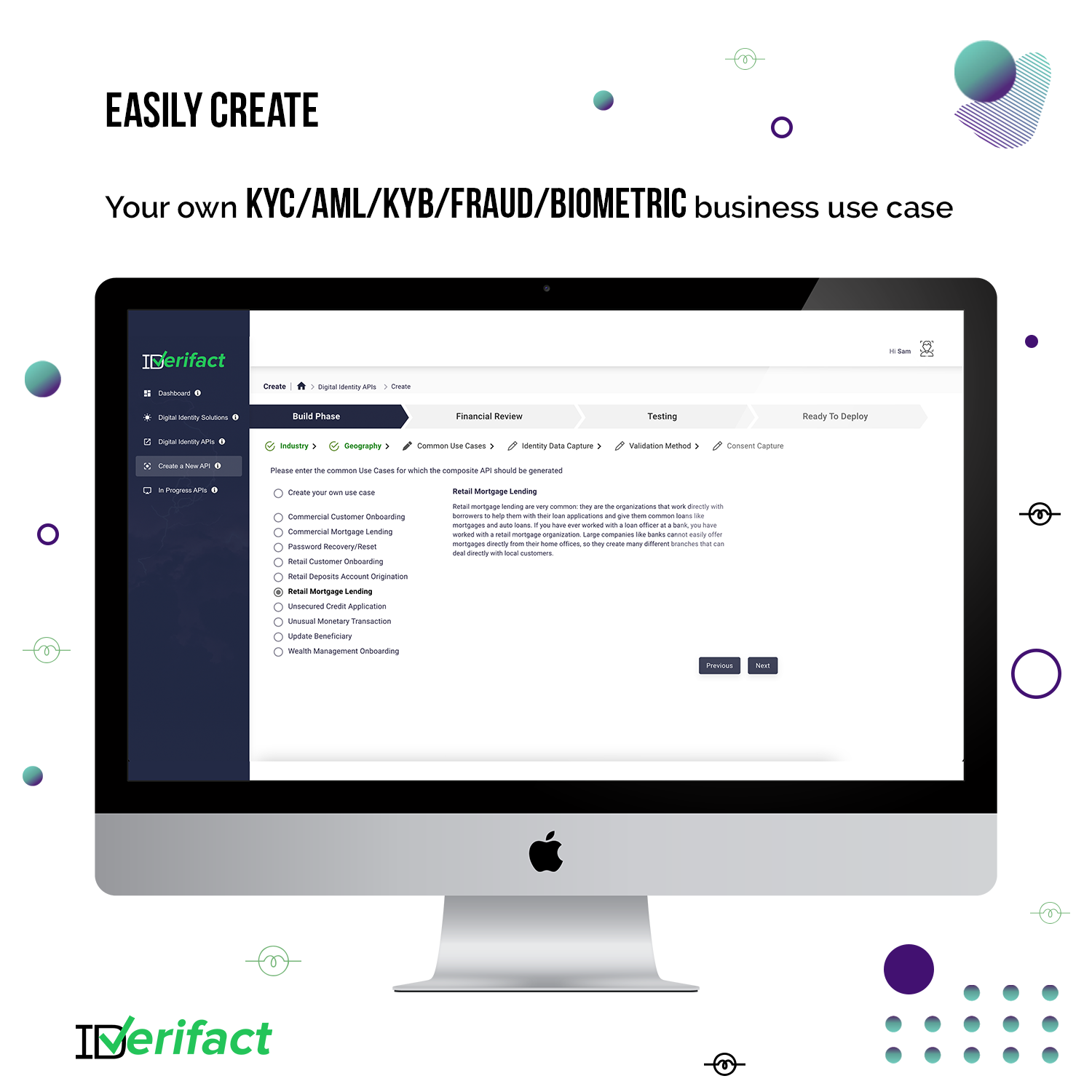

Integrating and orchestrating multiple identity providers costs a lot of money and takes a lot of time. IDVerifact offers something different. With a single integration, you can combine multiple digital identity solutions to meet any business use case. As your needs change, add new capabilities and functions so you can deliver continuous improvement in your clients’ experience. IDVerifact is also a white-label solution, so you have the ability to switch providers as required or leverage alternative providers for different use cases or jurisdictions.

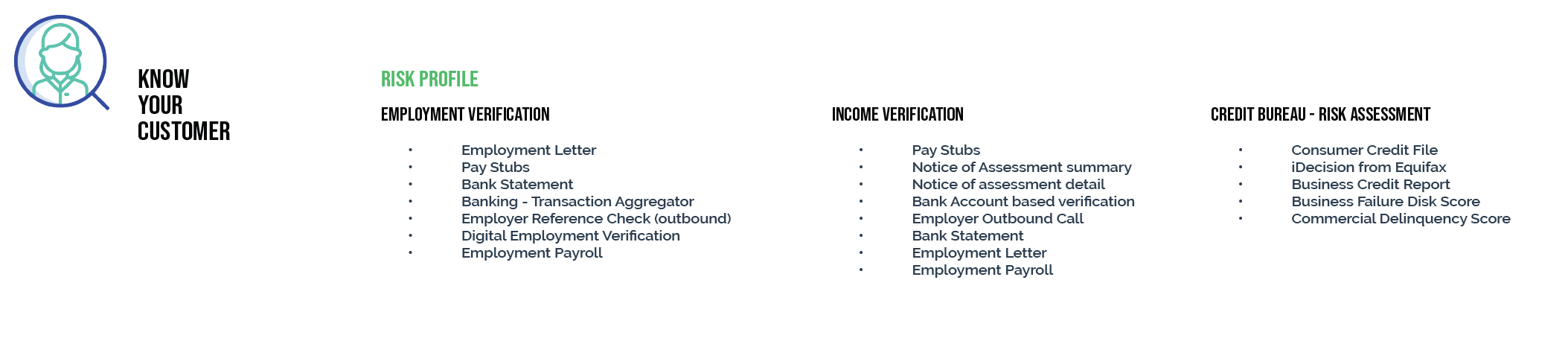

Whether you require employment verification, income verification, or access to the credit bureau to do a risk assessment, you can find this in our Risk Profile solution. This is particularly helpful because banks are obliged to carefully evaluate transactions to ensure that they match the location of the funds and the customer’s profile.

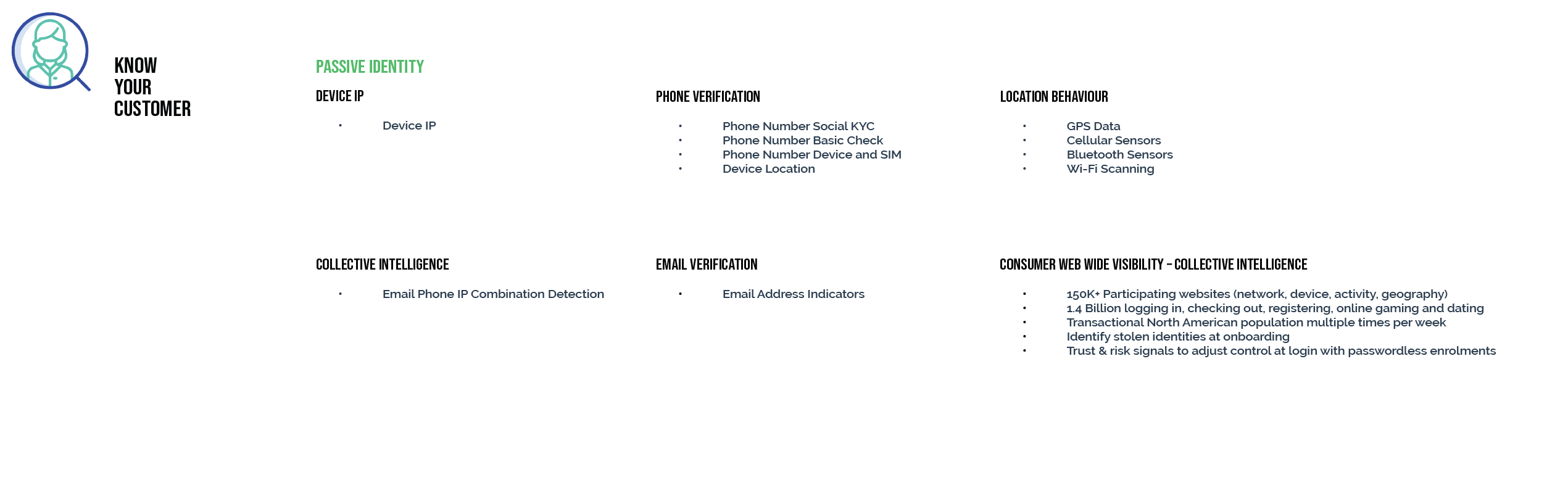

Regulated industries such as traditional banks and credit unions, newer financial institutions and fintechs, insurance, eCommerce, retail, real estate, law, eGaming, casinos, and others must ensure that their customers are who they say they are. Getting a glimpse into your customers’ devices, common locations, social media application and email address details would be beneficial because you need to know whether the person using the phone is who they say they are? Passive Identity enables you to ensure the device’s integrity. It provides supporting data to determine if the person is who they say they are and to detect anomalies such as the use of emulators, VPNs/proxies, and location spoofing.

When onboarding a new customer, the first step is to verify the user’s email or phone number. You must ensure that the email verification link was clicked on the same device on which the account was created and that the email was not flagged in any email verification databases.

A Passive Identity Check with IDVerifact ensures that you have a dependable method of detecting SIM swapping in real-time. You should combine GPS, cellular, Wi-Fi, and IP address data with our platform to get spoof-resistant location details from mobile carriers, cellular, Wi-Fi, and IP address data. Device intelligence solutions can determine whether a device has previously been associated with fraudulent activity and whether it is linked to multiple accounts.

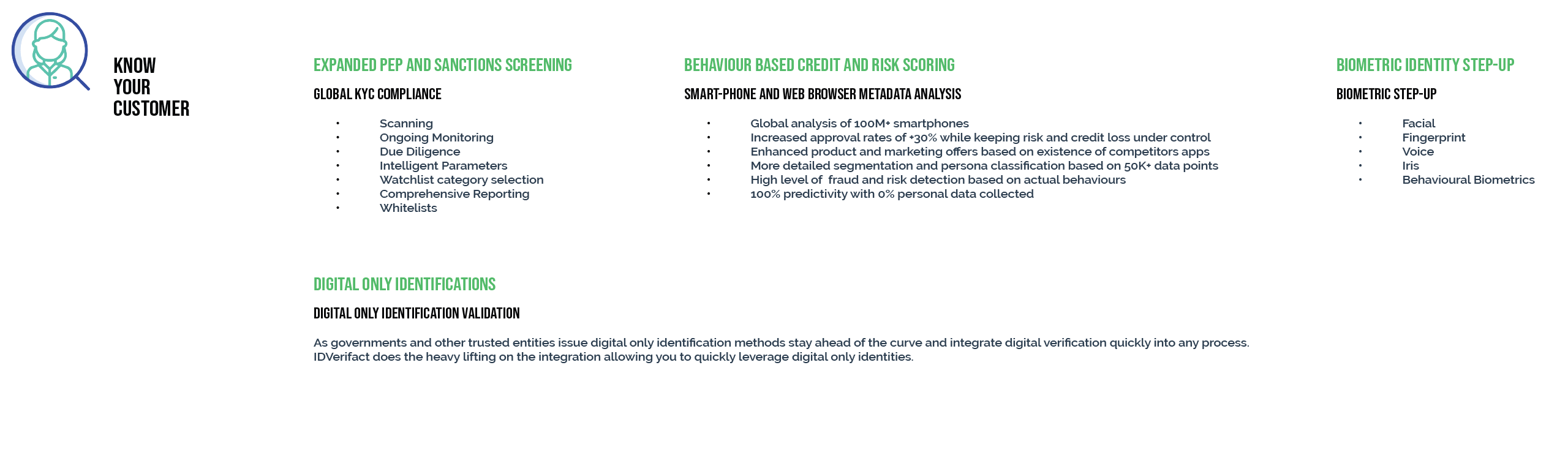

With the IDVerifact platform, you can get expanded PEP and Sanctions screening, Behaviour Based Credit and Risk Scoring, Digital Only Identifications, and Biometric Identity Step-up. These expanded solutions are meant to prevent financial institutions from being used by criminals for money laundering or financial terrorism. Our KYC solutions help banks better understand their clients and their financial transactions, allowing them to manage risk and avoid fraud.

IDVerifact will help you to:

- Partner with world-leading digital identity solution providers

- Provide your business the ability to assign composite APIs to specific projects and cost centres

- Normalize and standardize all data in advance for easy consumption

- Sort solutions into common categories that you can recognize and reuse

- Provide you with a visual, no-code, studio to design and publish composite digital identity APIs on the fly

The IDVerifact platform enables business users to choose the data and functionality required to handle specific use cases across many lines of business with a single integration. To receive a single composite data payload that meets the needs of each individual use case, simply combine any combination of our growing list of services.

Onboarding multiple identity providers costs a lot of money and takes a lot of time. IDVerifact offers something vital to your enterprise. Our platform delivers the most comprehensive and continually evolving suite of digital identity solutions, allowing your enterprise to simplify and secure digital transactions with its customers. If you need to expand your business use case, we offer AML, KYB, Fraud Detection, and Biometrics solutions on top of the KYC Identity Check.

Continuous monitoring is a required component of effective KYC procedures. As banks are expected to carefully examine the transactions to ensure that they match the customer’s profile and source of funds, running an IDVerifact KYC Check is detrimental to your brand.

Learn more about how IDVerifact can help you.